Interviews

From ancient Japanese martial arts to the creation of a sports robot that can communicate with people

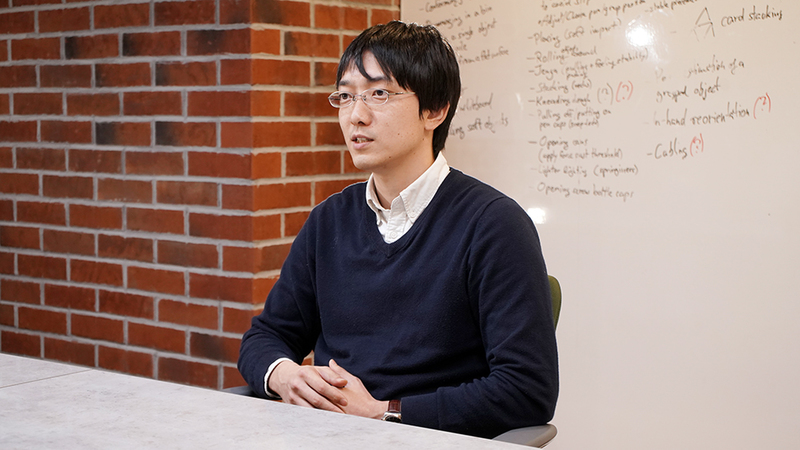

Kazutoshi Tanaka

Kazutoshi Tanaka (a researcher of sporting robots) is busy developing a robot that can be a companion to human beings in a variety of scenarios

Interviewer:Satoshi Endo、Author:Junko Kuboki、Translated by:FUJIYAMA, Co., Ltd.、Photography by:addingdesign LLC.

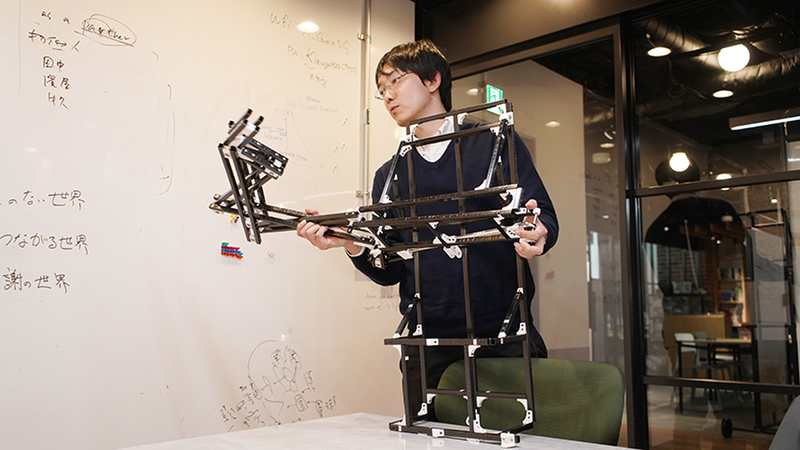

The under-development Table Tennis Robot and Mr. Tanaka

From Martial Arts

The first sports robot which Tanaka created, was one that reproduced particular techniques found in Japanese martial arts. Traditional Japanese martial arts feature a variety of body control exercises, within which exist some truly amazing techniques. One such technique allows you to “defeat your opponent without having to use any force at all.”

During his time studying for his postgraduate degree, Tanaka met Kunihiro Ogata - a senior member of the Intelligent Systems and Informatics Laboratory (currently at the National Institute of Advanced Industrial Science and Technology). After studying these martial arts, Ogata decided to incorporate motion-capture technology in an attempt to measure and scientifically analyze the body control exercises found in martial arts.The aim was to see if he could gain some clear understanding of the principles behind these techniques and discover if they could be incorporated into the design and manipulation of robots.

He then decided to collaborate in the lab with Yoshinori Kono, a Japanese martial arts master, to see if he could analyze the "pushing motion" utilized in one particular martial arts technique. The technique he studied involves the clenching of one of your fists and pushing back with that arm against an opponent who is pushing you with both of their hands, thereby forcing them to step back.

According to the results of the measurements and analysis, the secrets behind the pushing motion were as follows: 1) The use of the forward momentum of the body rotating, 2) The increase in rigidity of the elbow, by activating the extensor digitorum and flexor digitorum muscles, being used to push back against the opponent, and 3) The pushing back of the opponent in a direction they are not expecting and at a timing they are not anticipating.

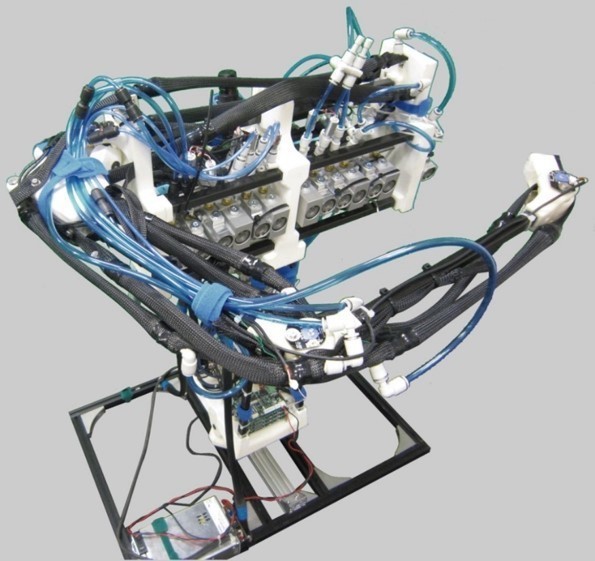

Tanaka took that know-how and applied it to his "musculoskeletal robot" which had been fitted with articulated joints activated by 12 pneumatic artificial muscles. When he looked at the video to see what type of movement was occurring, he could see that the human subject was forced backward in a staggering motion as a result of the action of the pedestal-fixed metal arm. It was a surreal and surprising moment for him. (There is a note in the video:https://note.com/sports_robot/n/n1842ccdafc14?creator_urlname=sports_robot)

The robot has a right arm, trunk, hips, is about the same size and weight as a human and has joints for its hips, shoulder, elbow, and wrist.

© 2012 Intelligent Systems and Informatics Laboratory

“The skills and expertise of masters of particular techniques and crafts could actually be recreated using the scientific method. The research showed us that the posture of the body is important. So naturally, I decided to look at the motions of assuming different body postures and created the ‘Receive Robot’ that jumped with its whole body in the direction of an incoming ball"

To Sports

The human-shaped Receive Robot continuously jumps in the path of the incoming ball and strikes at it. What Tanaka came to realize during the production of the robot was that “There are virtually no robots that can respond quickly to different types of situations.” There are plenty of robots that can repeat the same actions at high-speeds but is it not possible to create a robot that can respond quickly, and with the most efficient motion, to a ball coming from different directions each time?

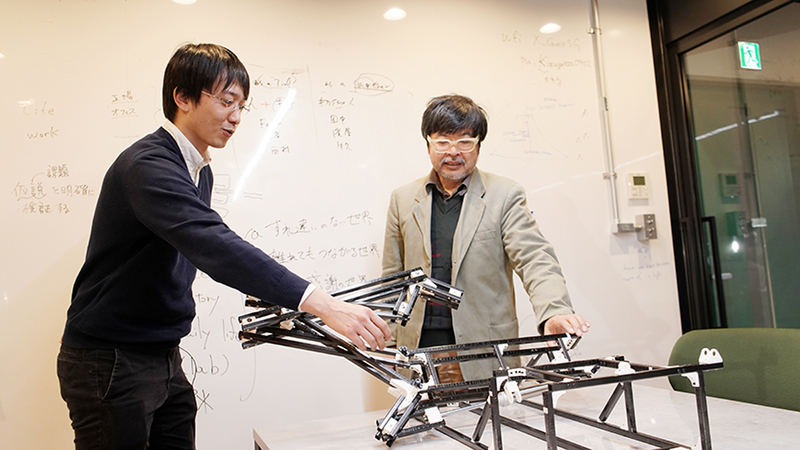

The next stage in the evolution of the Receive Robot is the ‘Table Tennis Robot’, which is currently under development. The development of table tennis sports robots has been happening since the 1980s. The reason for this is that table tennis is a simple 1 on 1 game with a light ball. Hence, it can be an ideal sport for testing and inventing a robot.

The robot was researched and developed to have a table tennis swing.

Tanaka does not see the situation as him developing a robot that is limited to just table tennis. Instead, he sees the development as being geared towards use in sports in general.

“I want to create a robot that can bring people joy. The goal is to create a robot that can form an excellent partnership together with a human teammate or opponent. It would be a little like a robot version of the relationship between a horse and its rider. I would like to create a situation in which humans can have fun competing together with robots in a sports environment.”

“If you go back over the development history of robots, the conversation has always been centered on 'dialog'. Essentially, robots converse in words and sentences through simple regurgitated text. I think it’s important to create robots that can understand non-verbal human communication, such as somatic sensations and other complex movements. In aiming for symbol emergence and cognitive developmental robotics like this, what I am looking to achieve is a sports robot, albeit one that starts as a table tennis robot.”

Sport is, in and of itself, a game, and as such involves practice and strategy. In each moment, there is movement from the opponent that seems chaotic, and the opponent’s next move can often appear impossible to predict. Yet, the competitors can sense things, predict their opponent’s play, select and judge the effectiveness of their own movements, and repeat practiced motions incredibly quickly.

“It has now become possible to perform research into how to predict your opponent’s movements. Using archaeological data on exercise information, we can show this using skeletal animation (motion capture) and predict an opponent's movement through this statistical data. We are, little by little, making progress in making predictions, something that we previously thought was incredibly difficult. It’s really interesting.”

The table tennis robot has already been developed at Tanaka's workplace, Omron. He wants the movement of the robot to be meaningful for humans.

There are also certain techniques developed and mastered by skilled athletes.

To Athletes

“Take the feint in baseball. A swing follows a set pattern, but by slightly adjusting the timing of the shoulder movement, the arm swing, or the rotation of the hips, the ball will fly in the opposite direction to which the pitcher expects, thereby becoming a feint. I look at the work of sports scientists unearthing the secrets behind these techniques and use their data as inspiration in the creation of my robots.”

The robot is unexpectedly simple. The cylinder for operation is attached to a carbon-fiber frame.

If robots are able to reproduce professional-level techniques, then they should be able to serve as training models for amateurs to hone their skills.

“The robot will be able to reproduce golf shots just like those of a professional golfer right in front of you. If you are able to strike the ball just like the robot demonstrated, then you should be able to produce a quality hit. That is the sort of thing I feel that we will be able to deliver on.”

The sports robot being developed by Tanaka is not something that will reproduce the performance of top-level athletes, but it can become a good companion with whom you can enjoy sports together.

It could be a “practice partner”, a “trainer”, a “teammate”, or even a “substitute” that can virtually play sports in your place. Tanaka says though that it should also be a "tool" used to understand the human body and human behavior.

“It is essential that it takes on a humanoid form.” The reason for this is that, if humans are unable to read the expressions and movements of the robot, it won’t be so much fun to play with.

To The Future

There are a lot of areas that require further research in terms of the mechanical and control systems that perform the sporting actions, the recognition systems that predict human movement, and the behavioral systems that allow humans to recognize its motions. The need to create a platform integrating each of these functions and is capable of exchanges with humans, along with the need to create a humanoid form that can operate at high speeds, has recently become a matter of some importance.

With all that being said, Tanaka is eager for everybody to try out the robot as soon as possible.

“The ultimate end-goal is to create a robot that looks and plays like a human being, but at the moment I am also developing a small toy-like Table Tennis Robot. I hope to sell the Table Tennis Robot globally for a price of around 10,000 JPY. I am aiming to begin sales of it within the next four years.”

Tanaka is an employee of the OMRON affiliate company, OMRON SINIC X. Usually, he is responsible for things such as AI for industrial assembly robots. The sports robot is his own project that he works on as part of the ‘20% rule’. Robots that are useful for business are the bulk of the company’s work, while robots that are designed for fun and entertainment make up around 20%. These two types of development are kept as separate forms of work.

Among the various ideas put forward for the Table Tennis Robot these past few years, there has even been a plan to implement a special “entertainment ”mode that would make players feel like they are in a close-fought match and they are ever so slightly behind.

“The idea is that the robot will not be too good, nor too weak and that it will have the ability to adjust its capabilities to just the right level of challenge. It shouldn’t just be a case of slowing down how fast the robot moves as this will not feel good for the human player. I think the first thing would be to work out exactly what this adjustment should be.

Perhaps in the future, robots will be like our friends and be able to visit us in our homes and lend a kind ear to us and our worries. Perhaps, they will even become our closest friends!

The first step to connecting people to robots is a sports robot.

Kazutoshi Tanaka

Kazutoshi Tanaka is a researcher who develops robots that can play sports. Born in Tokyo prefecture in 1987, he received his PhD from the Graduate School of Information Science and Technology, The University of Tokyo, in 2017. He is a senior researcher of OMRON SINIC X Corporation. He received ‘The 33rd Young Investigation Excellence Award’ in 2018 from The Robotics Society of Japan (RSJ).

Related URL:

https://www.youtube.com/watch?v=AHWflhBlX9A

https://www.youtube.com/watch?v=n2xblK9Lz_A

https://researchmap.jp/kazutoshi.tanaka